Start Now: How to Save Money, a Lot of Money.

Building a savings, whether it’s a $400 emergency fund or three months of expenses, is simple but will never happen unless you take these basic steps. Tweet

$400.

That’s the de facto benchmark for personal savings in the United States since 2012, the year the Federal Reserve added the following question to its annual Survey of Household Economics and Decisionmaking (SHED): Suppose that you have an emergency expense that costs $400. Based on your current financial situation, how would you pay for this expense?

Would an unexpected $400 bill push you over?

The 2020 SHED data shows 36 percent of adults would “have difficulty” paying the $400. That’s a lot of people and not a lot of money..

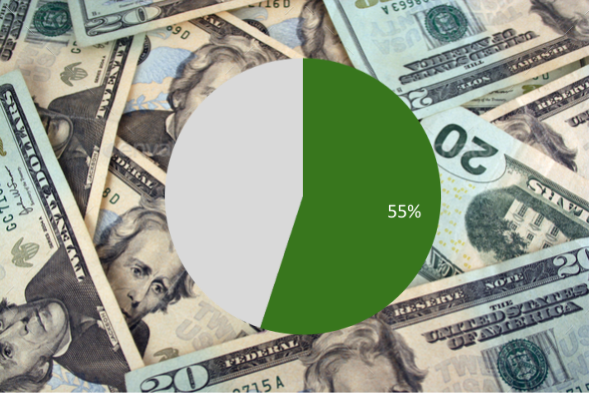

Another SHED staple is “Have you set aside emergency or rainy-day funds that would cover your expenses for three months?” Only 55 percent of U.S. adults have. That means nearly half haven’t.

Cash is king, gentlemen. Not credit. Not equity. Cold, liquid cash. Try marrying your best girl without cash. Try divorcing her. Try covering everything from a busted transmission to a busted flush without cash. Try losing a job, a lawsuit, a limb, without cash.

You get the point. U.S. savings rates have historically been in the single digits going back to the 1980s and spiking during the COVID-19 pandemic, but where do you stand? If you’re reading this, we can guess. So let’s go at the problem.

You can find lots and lots and lots of saving tips with a simple Google search, but they all boil down to some basic truths about building a nest egg:

–Automation is key. Designating a portion of your direct deposit income into a savings account – or setting up automatic transfers from a checking account on payday – is the easiest way to guarantee at least some cash gets stashed on the regular.

–If you don’t leave it alone, it will never grow. Imagine if you were able to stash 10 percent of your income in a savings account and leave it alone for one year. How much would you have? Exactly. Keep your mitts off the savings account. Pretend it has an STD. Forget about it.

–Ditto for windfalls. Beware the “wealth effect,” where we tend to save less money when we have more money. Why would we do something so dumb? It’s our brains telling us everything is okay because the money’s in our hands – and then we spend it. Again, imagine a year where every little cash bonus goes directly into the savings account, everything from $4 rebates on pet food to a job bonus to your tax refund.

Saving money is doable. But you have to do it.