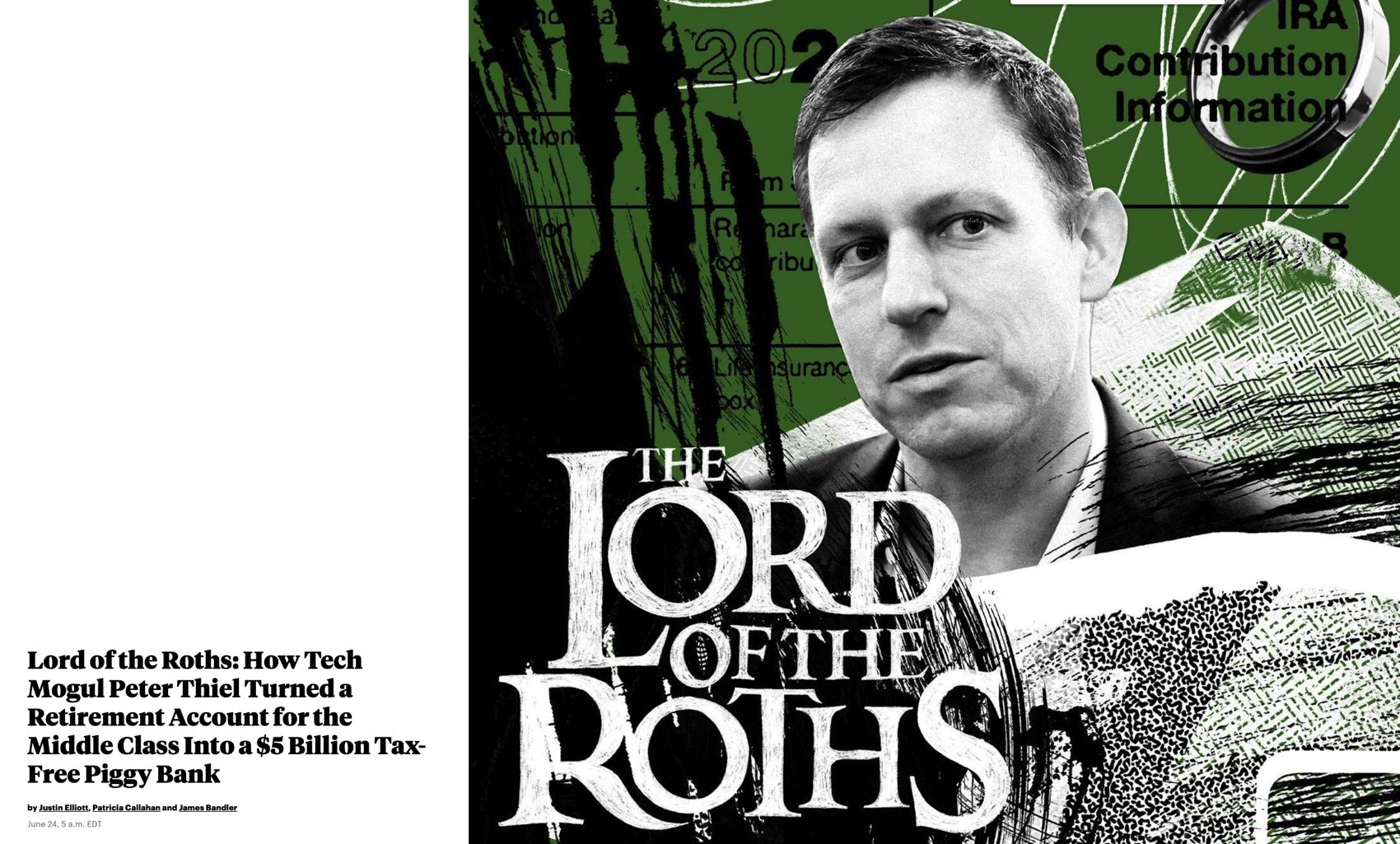

$5 Billion Dollars of Investing Advice, from a Penny-Stock Investor in PayPal

In a few broad strokes, here's how one founder of PayPal, Peter Thiel, used the same kind of Roth IRA that you and I have, to create $5 billion in untaxed income. You do have a Roth IRA, right? Tweet

Highlights

Smart investing is like body-building...

...you start small with what you've got, get a little obsessive, and never stop.

Peter Thiel is very rich.

He was a founder of PayPal.

He is one of Silicon Valley’s most powerful VCs, with early-stage investments in Airbnb, LinkedIn, Yelp, Spotify, SpaceX, and many other companies.

He was also Facebook’s first outside investor; in fact, if you saw The Social Network, you might remember the scene below where Thiel basically gives Mark Zuckerberg and Sean Parker a $500,000 investment in Facebook.

I think we can all agree that Thiel’s investment in Facebook was pretty smart; but what he did in his Roth IRA was a few billion times smarter.

In a few broad strokes, here’s how Peter Thiel used the same kind of Roth IRA that you and I have to create $5 billion in untaxed income:

- When he opened his Roth IRA, he invested as much as he could; which, in 1999, was $2,000.

- He used the money in his Roth to make a single shrewd investment: early shares of PayPal for $0.001 per share.

- A year later, thanks to PayPal, the value of his Roth IRA was $3.8 million or a gain of 227,490%.

- He then used the $3.8 million in his Roth to make additional investments which now have a value of over $5 billion; and he will never pay a dime of taxes on any of this gain as long as he does not withdraw any money from his Roth IRA until he is 59 1/2.

Should you be doing the same thing?

If you want to know more about how Thiel pulled off this $5 billion dollar tax coup, it’s all spelled out here.

You can read this ProPublica article about Thiel’s $5 billion Roth IRA one of two ways:

- You can be appalled that Thiel will never pay any taxes on this income (which is the tone the writers of the article strike);

- Or you can consider the article something of an instruction manual for how you can build a giant nest egg for retirement without paying taxes on it, too.

Assuming you, like us, are inspired by the article rather than appalled, we offer this last piece of ass-covering advice:

We recommend that you talk with a qualified accountant or financial advisor before you make any significant investment decisions.