Planned Manswers: When should I start taking Social Security?

Hey PM, I’ve got a problem.

When I ask Google for this:

What I get is this:

But I don’t want 1.7 billion results in .78 seconds; I just want you to tell me what I need to know.

Manswer:

1. For many people, Social Security is the ultimate mind-fuck. That’s why if you go to Amazon, you’ll see over 50,000 books have been written about it. And even if you read all 50,000 of those books, Social Security will still screw with your head. In fact, it may screw with your head even more not less, after you read a bunch of books about it.

2. Here’s why Social Security is such a mind-fuck: It’s a government program with hard-and-fast yet complex rules and deadlines and serious financial consequences, that forces you to confront everything you love and hate about yourself and your life, past and present and future.

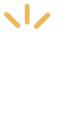

3. At the root of the mind-fuck: You can start taking Social Security at 62, or wait until you are 70, or start taking it anytime in-between. If you take it early, you get a lot less money every month. The longer you wait, the more money you get every month. A lot more. Or to say it another way, the more you need the money the less you get. And the less you need the money, the more you get. That’s a real mind-fuck, right?

4. So, now you have a choice:

Do you want to make this hard or do you want to make it simple?

Here’s simple:

Or here’s hard:

Over 50,000 books at Amazon about Social Security, and even after you read one or all of them good luck making a decision that you will believe every day for the rest of your life was the correct one:

Bottom line:

For most people, the best choice (but not necessarily the perfect choice) is pretty obvious if you don’t mind-fuck yourself over it.

If you desperately need it, take it. Yeah, that means you get less every month for the rest of your life but you desperately need it now. Sorry about that.

If you’ll never need it, then wait and take it and get more later. Because if you take it now, you won’t even notice you got it why why bother?

If you’re a smart investor, you might want to take it now even if you don’t need it, because you can invest it and create a far greater ROI than you’d get by waiting.

But if you’re a smart investor, you probably already have so much money that having a few more thousand to invest every month might not even matter.

So maybe you should just wait and maximize the size of those checks as a sort of insurance policy in case it turns out you’re not quite as smart an investor as you think, and then you’ve got the biggest possible Social Security check to fall back on in case you lose everything you’ve got.

Oh, and one more wrinkle: If you want to keep working after you start getting Social Security, you may find that your benefit checks get reduced.

Some resources that might be helpful:

Create an account here with Social Security to see an estimate of how much you will get at 62 and at 70, and at every year in-between.

Here’s more info from Social Security about your age, the impact of getting benefits early, like at 62, and the impact of getting delayed benefits, like at 70.

Here’s how much in Social Security benefits your spouse will get for you, if you die.

Here’s the fix for: “Oh, shit! I made the wrong choice. I started taking Social Security too early, and now I wish I’d waited.”

Here’s a link to 50,000 books on Social Security at Amazon.com.

Here’s a link to the 1.7 million Google search results we found on our question, “When should I start taking Social Security?”

Here’s a link to a really expensive bottle of scotch, and you’re going to need it if you spend too much time trying to figure this crap out.

One last note: PM’s Advertising Disclosure

When it comes to transparency, you can always count on us here at Planned Man to give it to you.

Here’s our policy on advertising and advertisers:

Our hope is that if PM does the homework for us all, you’ll click on the affiliated links that connect you to purchasing products. It’s a means of attaining happiness for all of us: you’ll enjoy the products you choose and we’ll eat. This is how we’ll cover the costs of answering our challenges at scale. Plus, you have our word: your choice will yield a value to you equal to or greater than its value to us.