How to pick the “best” credit card?

There is no such things as "the best credit card," because everyone's needs and spending habits are different. So how do you pick which is best for you? Tweet

Highlights

Buying stuff with a credit card is like shopping for bargains with a hooker.

It's fun and easy, but it's going to be way more expensive.

So in the end you may end up getting screwed...

...which is what happens when you use plastic.

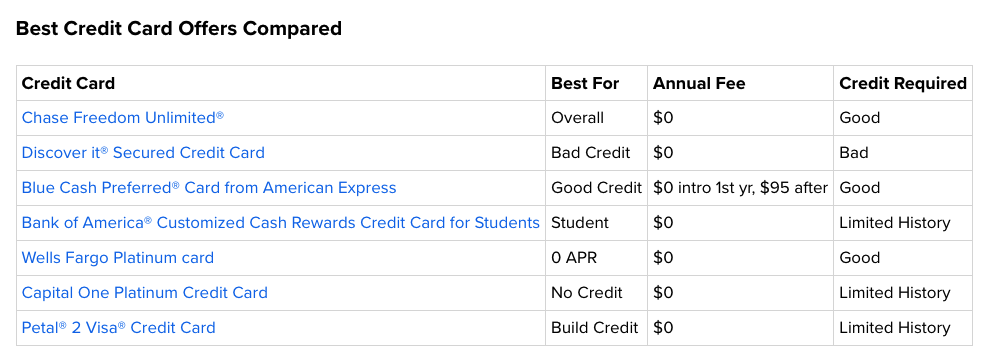

If you Google “What’s the best credit card?” you will get page after page of search results that look like this…

…and our advice is, don’t click on any of the links in your search results until you head over to Forbes.com and CNBC.com to first see their stories, both titled:

Why There’s No Such Thing As “The Best Credit Card”

The two articles, with the exact same title, take different approaches to explain the same thing:

There is no such things as “the best credit card,” because everyone’s needs and spending habits are different.

You can use both of these articles to help you determine which credit card is best for you, based on criteria like these:

- What’s your credit score?

- Do you pay off your full credit card balance every month?

- Are you willing to pay an annual fee to get premium services and benefits?

- What are your credit card goals:

- Cash back?

- Points for free travel perks like free flights or hotel rooms?

- Getting discounts from specific vendors or retailers like Costco?

- Making it easier to track expenses for business or tax purposes?

Once you know what kind of card you want, then visit a few of these sites that review credit cards.

But even as you’re browsing these sites, keep in mind that their reviews may be based on unbiased analysis of each credit card offer, or their reviews may be based on which credit card pays them the highest fees for the better placement or a better endorsement.

Any reputable site will offer some form of “Advertiser Disclosure” that transparently explains their relationship with credit card companies:

From Wallethub: Please keep in mind that while some offers may come from WalletHub advertising partners, sponsorship status played no role in card selection.

Compare that with BankRate’s Advertiser Disclosure: “The offers that appear on this site are from companies from which BankRate.com receives compensation. This compensation may impact how and where products appear on the site, including, for example, the order in which they may appear within listing categories.”

Which Advertiser Disclosure do you prefer?