Planned Manswers: I need a mortgage quick!

Hey Google, we don't want 3.6 million results in .92 seconds; We just want you to tell us what we need to know about mortgages! Tweet

Hey PM, I’ve got a problem.

When I ask Google for this:

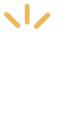

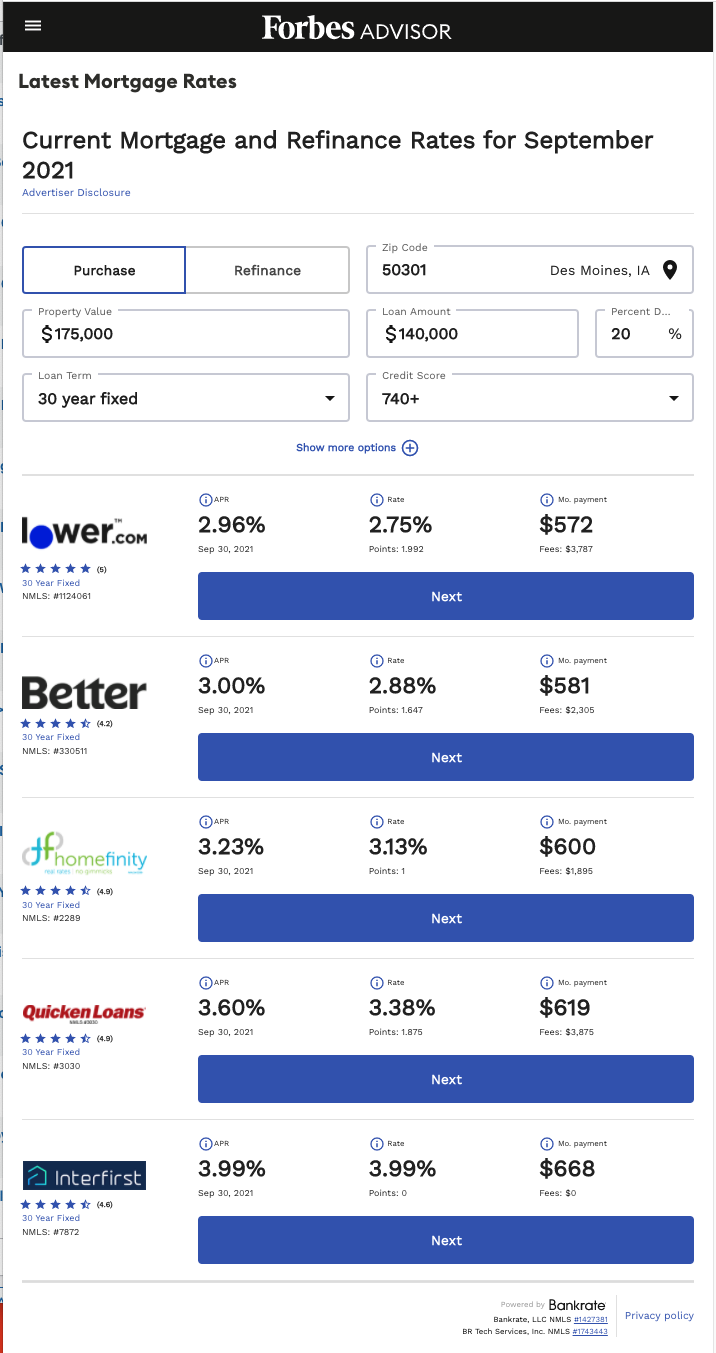

What I get is this:

But I don’t want 3.6 million results in .92 seconds; I just want you to point me towards a couple of sites I can trust that make recommendations

Manswer: Like these:

And hey, PM, can you make this even easier for me by telling me which of these lenders get the most recommendations from US News, Business Insider and Money:

| All three publishers recommend: |

Two publishers recommend: |

One recommendation: |

Quicken Loans and Rocket Mortgage by Quicken Loans |

|

|

Okay, PM, now that you told me where to go to get a mortgage, what else do I need to know?

| Out of 3.6 million search results, here are our top seven hits for learning the essentials on getting a mortgage:

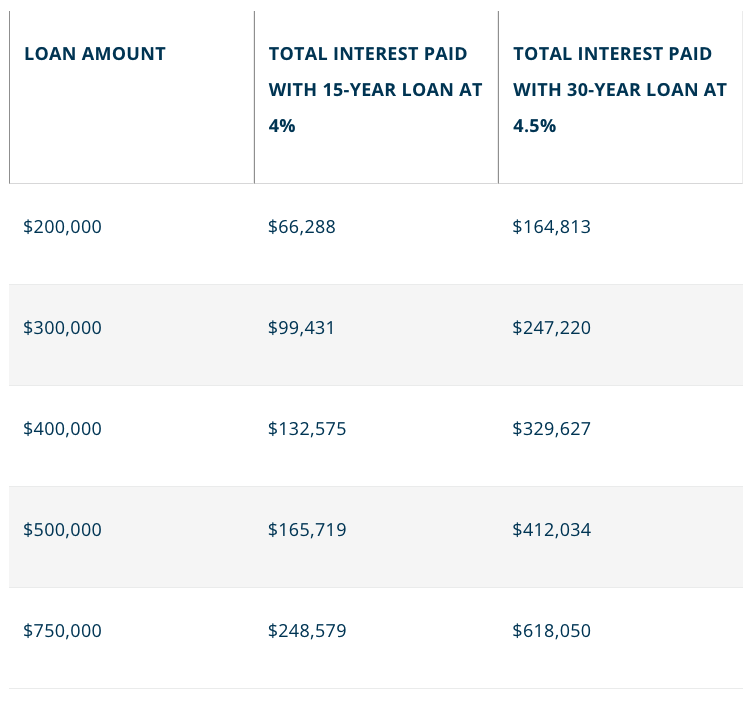

And here are four lessons about getting a mortgage you won’t learn from this Google search:

|

One last note: PM’s Advertising Disclosure:

When it comes to transparency, you can always count on us here at Planned Man to give it to you.

Here’s our policy on advertising and advertisers:

Our hope is that if PM does the homework for us all, you’ll click on the affiliated links that connect you to purchasing products. It’s a means of attaining happiness for all of us: you’ll enjoy the products you choose and we’ll eat. This is how we’ll cover the costs of answering our challenges at scale. Plus, you have our word: your choice will yield a value to you equal to or greater than its value to us.