Great American Stories: Taxing Concerns

Today is the 160th anniversary of the first federal income tax in the United States. It's not a date that gets much publicity, although it probably should. The ability to tax implies an ability to spend, which begs the big question: How much should be spent? Tweet

Today is the 160th anniversary of the first federal income tax in the United States. It’s not a date that gets much publicity, although it probably should. The ability to tax implies an ability to spend, which begs the big question: How much should be spent?

Although in 19th century America, it was generally understood that government couldn’t really spend more that it had, within a couple of years of passing an income tax, Congress was spending more than it was raising.

Most state constitutions require governors and legislatures to approve balanced budgets. The Founders never imposed such a requirement on Congress, which has proved to be an oversight. In between formulating a compelling rationale against the divine right of kings (a test they aced) and wrestling with the moral dimensions of slavery (a test they flunked badly), the creators of this country apparently didn’t understand the addictive nature of deficit spending.

The most recent year the books were balanced in Washington was 2001, but this is a misnomer. That year, the federal government ran a slight surplus, but the ever-accumulating national debt sat at $5.8 trillion, which was 55% of GDP, with no thought among policymakers to paying it down. In 2020, that number was $28 trillion, which represented 129% of GDP, and does not include underfunded Social Security and Medicare obligations.

This morning, a good-government group called Truth in Accounting estimates every Americans’ share of the national debt at $855,000, though it will be more by tomorrow.

In the meantime, Joe Biden and Democratic Party leaders on Capitol Hill are proposing $4 trillion in new spending on social programs and “human infrastructure.” They say it can all be offset by increasing the corporate tax rate and further dinging the wealthy, but in one basic way this is a shell game: With the current year’s federal deficit projected to be $3 trillion, any new spending is on borrowed money.

Congressional Republicans are objecting to all this, naturally, and although I don’t mean to embarrass them, it’s fair to ask why they suddenly become fiscally responsible only when a Democrat is in the White House. When Donald Trump became president, the debt was just a tad under $20 trillion, meaning that it grew by $8 trillion in only four years.

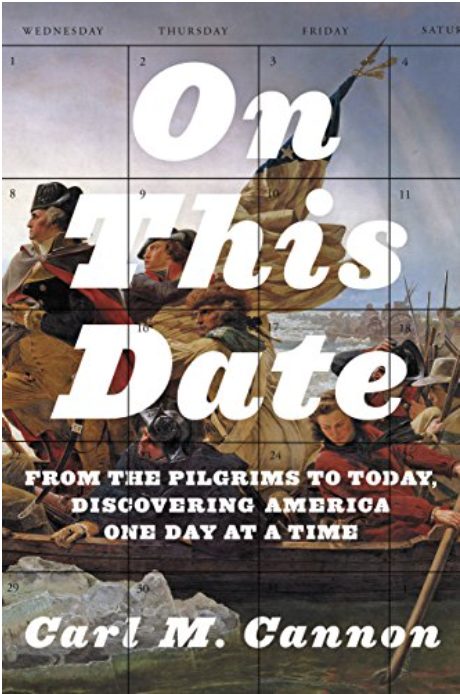

America’s first income tax was signed into law by its first Republican president on Aug. 5, 1861. With a massive number of troops mustered in response to the attack on Fort Sumter, the 37th Congress was looking at a $30 million projected budget deficit for the coming year. Its response was the Revenue Act. Like the Bush-era tax policies of 2002, the 1861 law was both regressive and progressive at the same time.

The statute signed by Abraham Lincoln called for a flat tax rate of 3 percent on net income — and 5 percent on Americans living abroad. That was the regressive aspect. The progressive feature was that annual income under $800 — slightly less than $20,000 in today’s dollars — was exempt. The rates were changed the following year, and the tax rescinded in the 1870s. It was brought back in the early days of the 20th century, debated all the way to the Supreme Court, and sent to the states for a constitutional amendment.

By the 21st century, the tradition of Congress taxing the American people was so ingrained in the national psyche (not to mention law and court precedent) that a chief justice of the Supreme Court, searching for a reason to uphold a constitutionally questionable health care “mandate,” solved the legal riddle by calling the mandate’s penalty “a tax.” Voila! Or, as Benjamin Franklin reminded a friend in a 1789 letter: “Our new Constitution is now established, and has an appearance that promises permanency; but in this world nothing can be said to be certain, except death and taxes.”

Carl M. Cannon is the Washington bureau chief for RealClearPolitics. Reach him on Twitter @CarlCannon.